Raydium

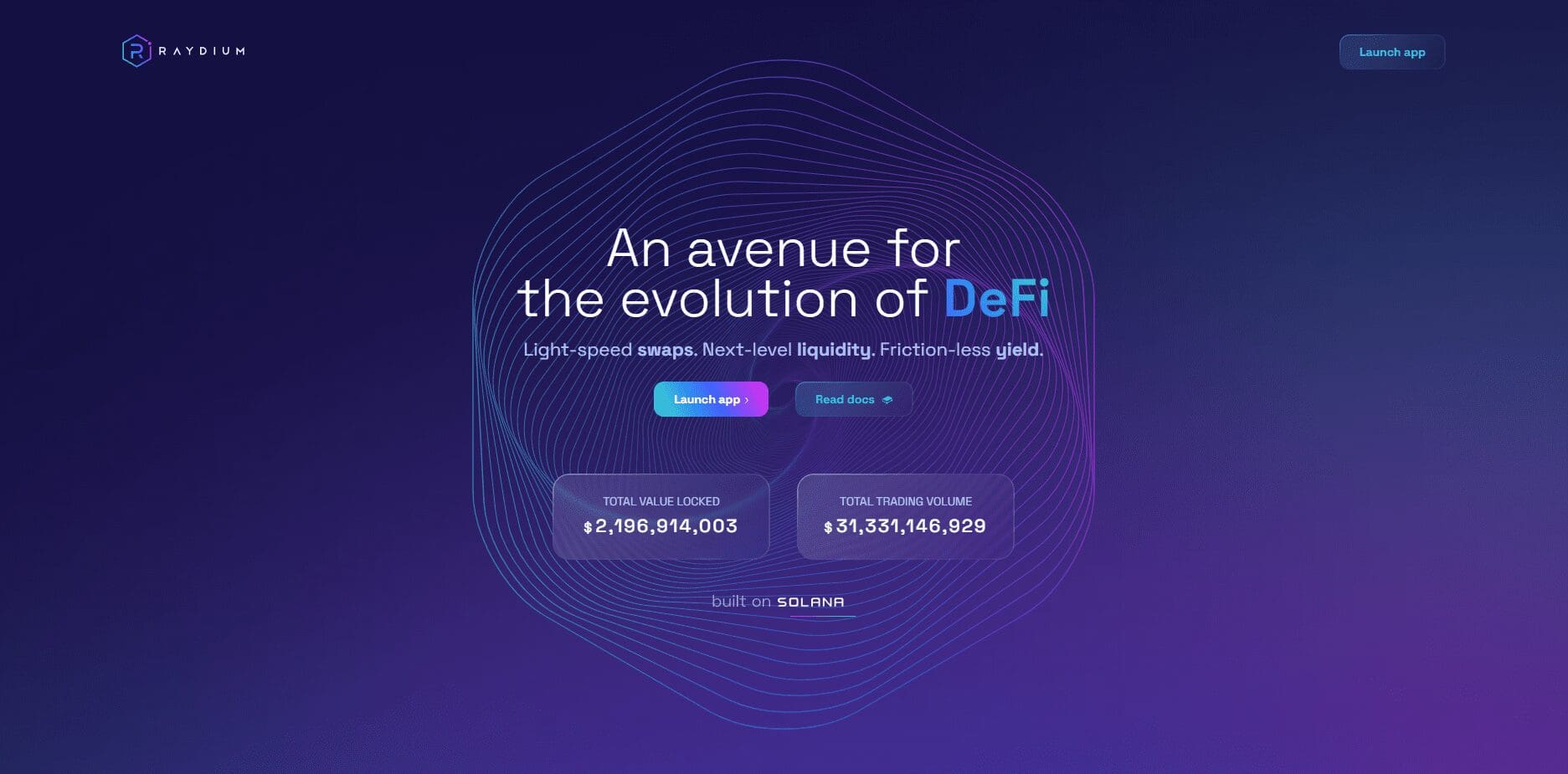

Raydium Swap: The Premier DEX on Solana

Experience lightning-fast and ultra-low-cost decentralized trading on Solana’s high-performance blockchain.

Introduction to Raydium

Raydium is a decentralized automated market maker (AMM) and liquidity provider built on the Solana blockchain. It leverages Solana’s low latency and high throughput to offer a fast and inexpensive DeFi experience. Unlike traditional AMMs, Raydium integrates directly with Serum — a central limit order book (CLOB) DEX — giving users access to both AMM liquidity and order book depth.

How Raydium Swap Works

Raydium enables users to swap tokens instantly and at low cost via its AMM pools. The integration with Serum means that users’ orders are matched not only against liquidity pools but also with orders on Serum’s order book. This hybrid model increases trade efficiency, slippage control, and liquidity depth.

Key Features of Raydium

- Solana-based: Built on a high-speed, low-fee blockchain capable of processing 65,000+ TPS.

- Serum Integration: Trades are routed to Serum’s order book, improving execution.

- Yield Farming: Earn RAY and other tokens by farming liquidity pairs.

- Staking: Stake RAY tokens for governance and passive income.

- Launchpad (AcceleRaytor): A platform for launching new Solana-based projects.

What is the RAY Token?

RAY is Raydium’s native utility and governance token. Holders can stake RAY to earn rewards, participate in decision-making via governance proposals, and gain access to project launches through AcceleRaytor.

Liquidity Pools & Yield Farming

Users can supply token pairs such as RAY/USDC or SOL/USDT to earn LP tokens. These LP tokens can then be staked in Raydium Farms to generate high-yield rewards in RAY and sometimes other project tokens. Raydium offers both standard and dual-yield farms, enhancing returns for DeFi participants.

AcceleRaytor: Token Launchpad

AcceleRaytor is a token launch platform that helps new Solana projects raise capital and gain initial liquidity. Participants can contribute USDC or RAY tokens to buy into these early-stage offerings. It democratizes access to promising new ecosystems and projects.

Raydium vs Other DEXs

Compared to Uniswap and SushiSwap on Ethereum, Raydium offers a unique value proposition by merging AMM and order book models. While most AMMs settle trades purely via pool logic, Raydium dynamically connects to the Serum DEX — bringing centralized exchange-like execution speeds and depth to DeFi.

Advantages of Raydium

- Ultra-fast settlement (<1 second)

- Negligible gas fees (fractions of a cent)

- Order book support via Serum

- Robust ecosystem tools (farming, staking, launchpad)

- High liquidity from both AMM and Serum markets

Wallet Compatibility

Raydium supports various Solana-compatible wallets including:

- Phantom

- Solflare

- Slope Wallet

- Ledger (via Sollet)

Security and Audits

Raydium has undergone smart contract audits and uses best practices for DeFi security. Although no protocol is 100% immune to risks, the team remains transparent and has implemented emergency recovery plans and bug bounties.

Getting Started with Raydium

- Install and fund a Solana wallet (e.g., Phantom)

- Visit raydium.io

- Connect your wallet to access the app

- Use the Swap tab to exchange tokens

- Add liquidity to start farming and earning RAY

Frequently Asked Questions

1. Is Raydium Swap safe to use?

Yes. While DeFi always involves risk, Raydium is a leading Solana DEX that has undergone audits and follows industry security standards.

2. What is the benefit of Serum integration?

It allows Raydium to offer better liquidity, lower slippage, and more accurate pricing by accessing the entire Serum order book.

3. How can I earn RAY tokens?

You can earn RAY by providing liquidity and staking LP tokens in Raydium Farms, or by staking RAY itself.

4. Does Raydium support NFTs?

No, Raydium is primarily focused on DeFi trading and yield opportunities, but you can use Solana wallets to manage NFTs separately.

5. What is AcceleRaytor?

It’s Raydium’s project launch platform that allows users to invest in new Solana-based tokens early, often with allocation rewards for RAY holders.

6. Which wallets can I use with Raydium?

Popular options include Phantom, Solflare, Slope, and Ledger (via Sollet). Phantom is the most widely used for Raydium trading.

Made in Typedream